Renewal Your Hong Kong Company

Under Hong Kong Company Law, and Hong Kong Inland Revenue Law, a Hong Kong company is required to do (A) Annual Filings to the Hong Kong Companies Registry, as well as (B) the Tax Filing.

For (A) Renewal filing (US$600):

1) Recollecting the business registration certificate (including our service fee and government fee)

2) Preparing annual return and file to Companies Registry (including our service fee and government fee)

3) Appointment of corporate secretary for a year

4) Providing registered office address for a year

Note: The renewals include:

- Providing public phone line for a year;

- Providing public fax line for a year

- Receiving Mail and Mail forwarding for a year;

- Appointment of compliance officer for a year;

- Appointment of data information officer for a year;

- Keep and maintenance of the Significant Controllers Record for a year.

For (B) The Tax filing (US$400)

Every year, the Hong Kong tax department will issue a profits tax return to the Company, and it requires the company’s accounts to be filed to tax department. Certainly, in your case, as it is offshore in nature, the tax department will not require you to pay Hong Kong Tax, even they will issue a confirmation to confirm that your company profits are exempted from profits tax in Hong Kong.

The general procedure is that we will prepare for Declaration Report of Non Business Engaged in Hong Kong, and Specific Power of Attorney for you so that we will be appointed as your attorney and will attend answering the enquiries made further by the Hong Kong Tax Department and deal with all tax issues on your behalf, and filing to the Hong Kong Tax Department, and confirm that your company is offshore in nature, and is no required to pay the tax in Hong Kong.

For the fee, we charge on average starting from US$500 for a year including preparation of documents of Declaration Report of Non Business Engaged in Hong Kong, Specific Power of Attorney, Fill up the Profit Tax Return under BIR51, following up the actions made by Hong Kong Tax Department in regarding to further returns under s.51(3), to provide further information to Hong Kong Tax Department under s.51(4)(a), and attend for the matter of your tax issues under s.51(4)(b). (It is required to proceed after (A) is fully completed.)

For (A) and (B). However, we can charge ONLY US$1,000 for your Company including:

For (A)

1) Recollecting the business registration certificate (including our service fee and government fee)

2) Preparing annual return and file to Companies Registry (including our service fee and government fee)

3) Appointment of corporate secretary for a year

4) Providing registered office address for a year

And (B)

5) Prepare for Declaration Report of Non Business Engaged in Hong Kong

6) Specific Power of Attorney

7) Fill up the Profit Tax Return under BIR51

8) Following up the actions made by Hong Kong Tax Department in regarding to further returns under s.51(3)

9) Provide further information to Hong Kong Tax Department under s.51(4)(a)

10) Attend for the matter of your tax issues under s.51(4)(b)

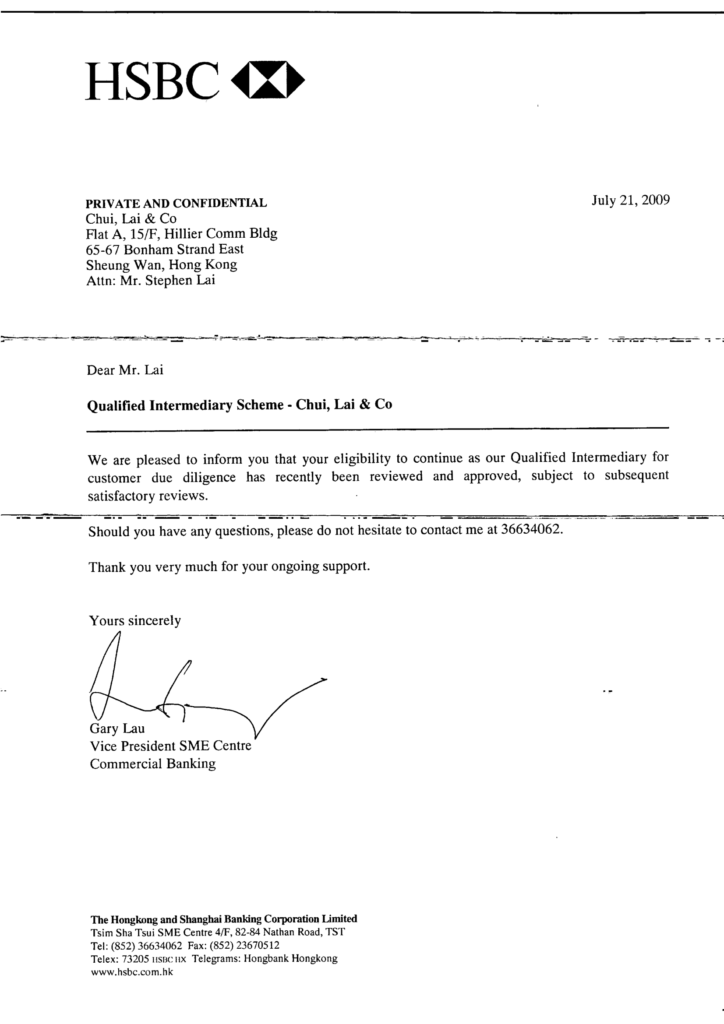

QI license

Bank Achievements for years